LIBRARYライブラリー

THAILAND 国・地域情報 会計・税務

【THAILAND】Regulation on VAT Input Tax Credit Limitation

2025.06.26

Overview

Regarding the monthly final VAT return and calculation of VAT payable, the rules for calculating input tax credits for VAT on common expenses applicable to both taxable and non-taxable sales have been clarified. Under these rules, for example, it is now clear that VAT on expenses related to triangular transactions (so-called ‘outside-outside transactions’) from Thailand’s perspective cannot be deducted. Note that these rules have been in effect since February 2025.

Content of the Provision:

In February 2025, the Thai Revenue Department issued and implemented Departmental Instruction No. Paw. 164/2568, which amends the VAT input tax credit provisions for businesses selling goods outside Thailand. This provision affects businesses engaged in both VAT-taxable sales and non-taxable sales.

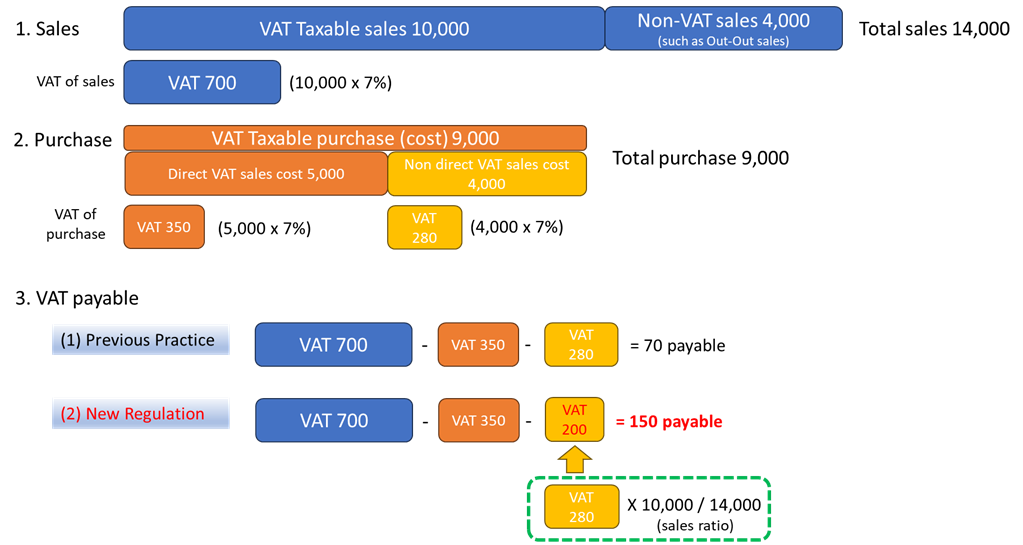

The allocation of input tax amounts is calculated by applying the ratio of VAT-taxable sales to non-VAT-taxable sales to the VAT amounts associated with the purchase costs of goods or services used for both types of sales. For details of the regulations, please refer to the Thai Revenue Department website and Departmental Instruction No. Paw. 164/2568.

Specific Calculation Example:

In a case where there is VAT-taxable sales of 10,000 and non-VAT-taxable sales of 4,000, as shown in the following diagram, the result is an increase of 80 in the tax amount compared to previous practices.

Note that under this regulation, the VAT amount that is no longer eligible for deduction (80 in the above example) is treated as an expense (cost) in the calculation of corporate tax.

If you have any concerns, please do not hesitate to contact us.

Contact Us

please fill in this form.