LIBRARYライブラリー

THAILAND 会計・税務 国・地域情報

【THAILAND】Up to 50,000THB deduction from personal income tax for 2024

2023.12.28

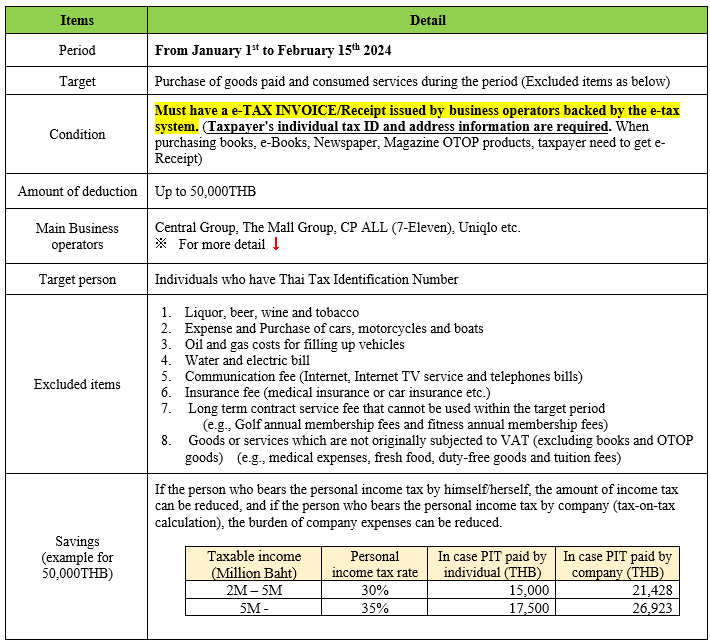

On December 4th 2023, the cabinet approved the program “Easy e-Receipt” for personal income deduction up to 50,000THB to stimulate domestic consumption and promote entrepreneurs to register VAT system. You can reduce your personal income tax amount in 2024 by using this shopping deduction.

- For more detail ⇒ https://www.rd.go.th/fileadmin/download/news/info_etax.pdf

If you would like to enjoy this deduction, please kindly send us of scanned e-Tax Invoice or e-Receipt until 29th February 2024 (Please send all data in one time). We will apply on March 2024 payroll. On behalf, you can request to refund overpaid personal income tax at your FY2024 annual tax return (PND.91) by the end of March 2025. However usually, revenue department officer requests you to provide all of the evidences for the refund, so we recommend applying on monthly payroll. Thank you very much for your corporation and consideration.

If you have any concerns, please do not hesitate to contact us.

Contact Us

please fill in this form.